Online Activities

Online Activities

- GoVenture includes 10 ONLINE Activities that help you learn and practice key financial concepts.

- These activities must be turned ON by your instructor. Once ON, you can play the Activities by logging in to GoVenture.

- Information on how to play each Activity is included below. For data to input into each activity, use your own personal profile, the Mo profile included below, or the profile provided by your instructor.

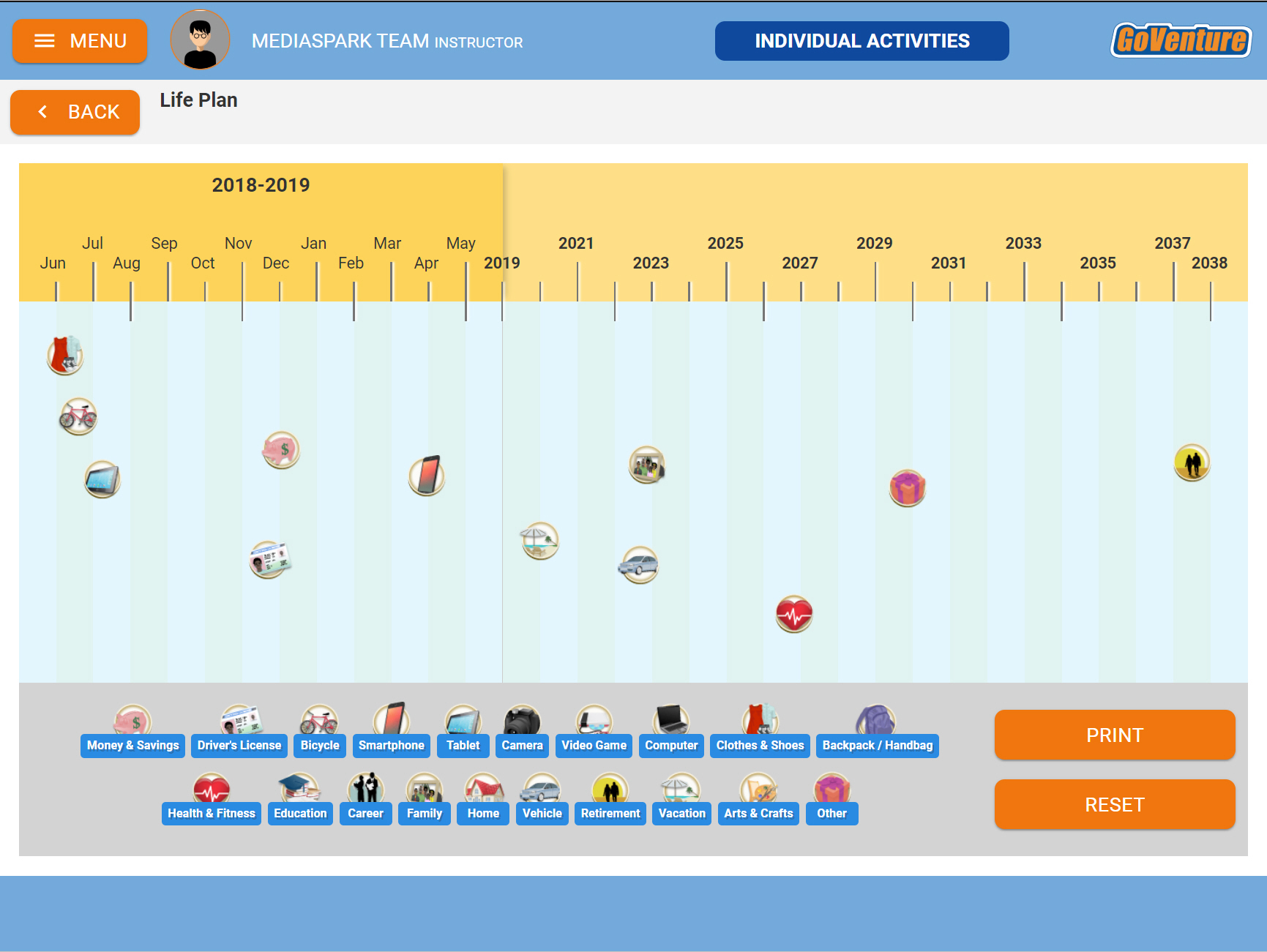

1. Life Plan Activity

As you think about your future, you may have items you want to own and accomplishments that you want to achieve. These life goals often require time and money.

By planning your future, you can make better decisions to help you achieve your goals. The Life Plan is a tool to help you plan and visualize your future.

When choosing your life goals, consider the difference between needs and wants.

Needs are things that are essential, regardless of your financial condition, such as food, shelter, and clothing. These items are necessary for maintaining life, and unless these needs are met, there is little necessity for other things.

Wants are things that you might wish to have, but not having them will not threaten your existence, such as a new television, video games, and taking a vacation. Wants are items you can live without, but would very much like to have.

One of the most important parts of financial planning and goal setting is learning how to spend money wisely. To do so, your primary goal should be to spend money based on your needs first, and then take care of your wants.

Understanding the difference between what is needed and wanted helps you prioritize spending and keeps you on the path to achieving your long-term financial goals.

How to Play

- There is a 20-year timeline along the top of the screen. The first year is in months, starting with the current month. The timeline is used to identify when you want to achieve your goals.

- There are a number of life goals at the bottom of the screen. Life goals are items you want to own or achievements you want to accomplish.

- Choose a life goal and then click and drag it up under the timeline. Release the mouse button to stick the goal to the timeline near the month or year by which you want to accomplish the goal. A window will appear where you can enter details about the life goal. Entering details is optional. Click OK to save changes or CANCEL to discard them.

- You can click a life goal to edit the details. You can click and drag a life goal to move it elsewhere on the timeline. Or, you can move it off of the timeline to remove it.

- Repeat the steps above to complete your Life Plan by adding more life goals.

- Use the PRINT button to print to paper or save as an electronic file (pdf). You will also see the total amount of money you will need to achieve your life goals (based on the details you entered for each life goal). Write your name down on the printout if you will be submitting to an instructor.

- Use the RESET button to erase your data or start over.

Mo

Map the Life Plan for Mo.

You

Prepare a Life Plan based on your own life goals.

| Learn more about this topic |

|---|

2. My Money Profile Activity

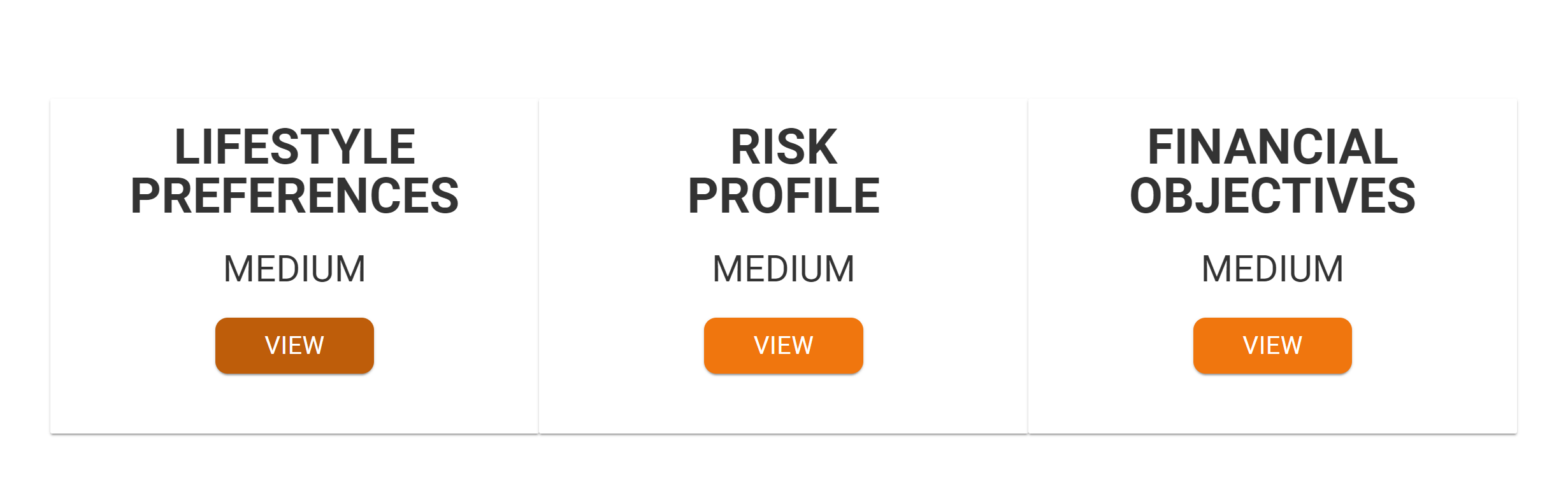

By answering three questions, you can get a basic sense of your own Money Profile. Your Money Profile may change over time as you gain more life experience.

How to Play

- Click the VIEW button. A window will appear with three options – click the one that best matches your personality.

- Repeat the steps above for each of the questions.

- Use the PRINT button to print to paper or save as an electronic file (pdf). Write your name down on the printout if you will be submitting to an instructor.

- Use the RESET button to erase your data or start over.

Mo

Determine the Money Profile for Mo.

You

Complete your own My Money Profile.

| Learn more about this topic |

|---|

TOP

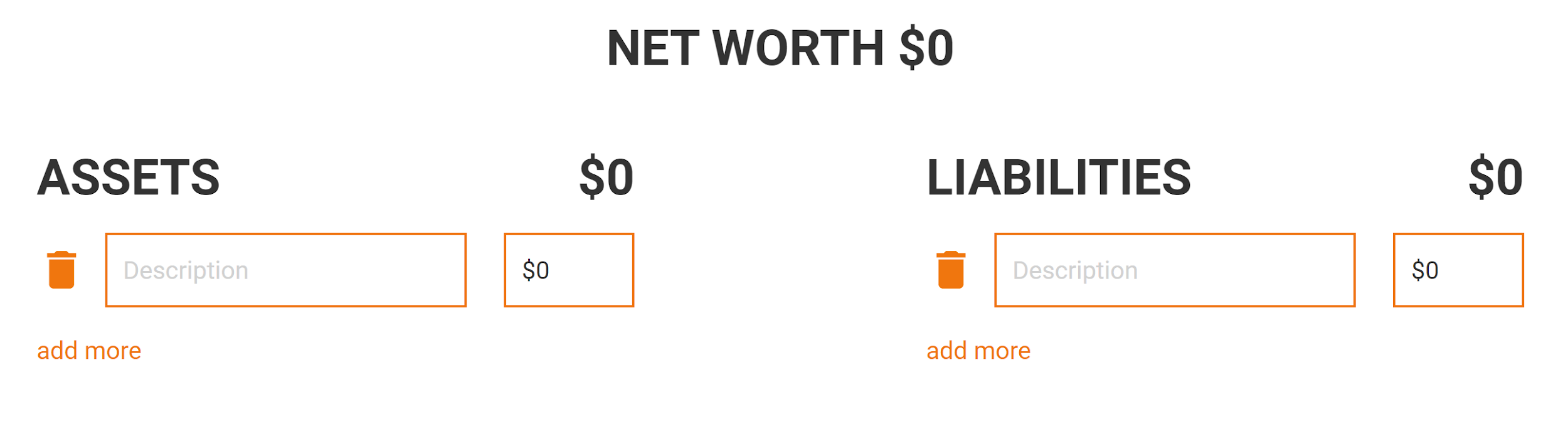

3. Net Worth Activity

Assets

An asset is an item of economic value, which you own, and which is cash or could be sold for cash. It is important to distinguish between an item of economic value and an item that may only have sentimental value. The financial value of an asset is the amount the asset could be sold for today, it is not what you may have originally paid for the asset. While something may be emotionally important to you, if no one will buy it, then it is said to have no cash value and is not considered an asset.

Liabilities

A liability is a debt — money or equivalent monetary value of things that you owe someone else. You have liabilities to your telephone company for using their service. You may have credit card bills, a mortgage, a car loan, or other types of borrowings or payments due. The amount of a liability is what you owe as of today, not the original amount, or last month’s bills. For a loan, the liability is the total amount of the principal that is still owing, plus any past interest that has not been paid, future interest is excluded.

Net Worth, also called equity, is the total worth of the things you own (your assets) minus all your debts (your liabilities). Or, you can think of it as the amount you would have left over if you sold all your assets and paid off every single one of your debts today. If the number is positive and growing, that is good. If your net worth is negative and shrinking, you may be in financial trouble. Here is the formula ...

Net Worth = Assets — Liabilities

Here is an example of a net worth calculation:

How to Play

- Under ASSETS, click ADD MORE and enter the description and amount of an item you want to add. Repeat this step to add all ASSETS. Click the trash can to remove an item.

- Under LIABILITIES, click ADD MORE and enter the description and amount of an item you want to add. Repeat this step to add all LIABILITIES. Click the trash can to remove an item.

- NET WORTH is automatically calculated based on ASSETS minus LIABILITIES.

- Use the PRINT button to print to paper or save as an electronic file (pdf). Write your name down on the printout if you will be submitting to an instructor.

- Use the RESET button to erase your data or start over.

Mo

Play this activity to determine the Net Worth for Mo, based on his current assets and liabilities. For simplicity, use the Asset values provided in the profile and do not try to estimate the value of what the asset could be sold for.

You

Complete your own Net Worth statement.

| Learn more about this topic |

|---|

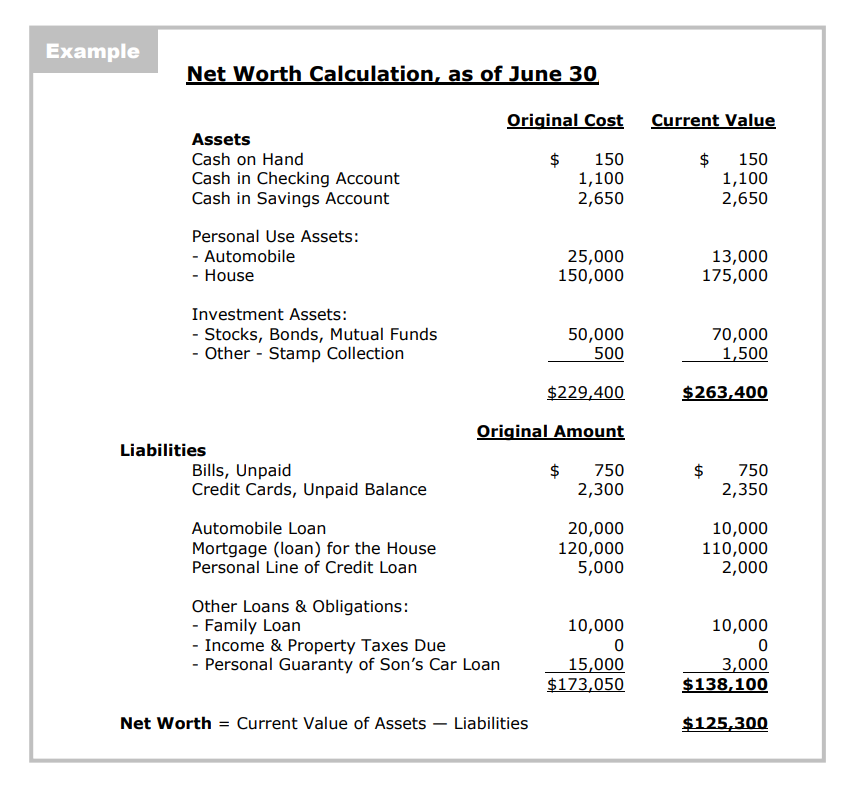

4. Budget & Cash Flow Activity

Cash Flow

Making money and spending money represent the basic concept of Cash Flow — how money flows in and out of your accounts: Money in minus money out.

Cash Flow = Money IN – Money OUT

Making money represents all the ways you receive money. You might make money by working at a job, by buying and selling stocks, earning an allowance, or even winning the lottery. These are your sources of incoming cash and are called Income – this is your Money IN.

Money OUT

Spending money is something that most people find easy to do. Spending represents the uses of your money. Your current expenses cover the essential cost of living — expenses such as housing, transportation, food, and clothing.

Additional discretionary expenses include entertainment, extra clothes, hobbies, education, and charitable donations. Discretionary expenses are those expenses over which you have more control, and which are not mandatory for you to live and earn your wages.

Money you spend for living and discretionary purchases are Money OUT.

Money OUT also includes money you set aside for saving, an emergency fund, etc. Your not spending this money, so it is not considered an expense. But, it is recorded as Money OUT because it affects your Budget and Cash Flow, as it is money that you have chosen not to make available for other purposes.

Period

The PERIOD is the duration of time in which you are tracking your Money IN and Money OUT. Often, this is monthly, but could be weekly, quarterly, yearly, or other time period. For example, with a monthly time PERIOD, you list your Money IN and Money OUT during that particular month.

NOTE: When converting a weekly amount to a monthly amount, multiply by 4. When converting a monthly amount to weekly, divide by 4. This is not exact, but makes it simple. The more exact multiplier or divisor is actually 4.334.

Calculating your Money IN minus Money OUT tells you if you will have enough money available to pay your bills and set aside for saving.

Deficit – you have more Money OUT than IN. Not so good! You have to reduce what you are spending money on, or reduce savings, or find a way to make or borrow more money. Having a deficit is also called being “in the red”, which refers to the ink color bookkeepers historically used to mark down negative numbers.

Budget

A Budget is an itemized list of estimated expenditures and the expected ways to pay for them, for a given time period. By budgeting you can manage your finances better, and watch to make sure you don’t spend more money than you budgeted.

In addition to income and expense items, Budgets often include planned amounts for savings or investment. For example, you might have money taken out of your pay cheque for a retirement plan. Or, you might make monthly payments to a savings account or emergency fund. These are uses of your cash that may remove it from easy access, but the money is still yours. Think of it as paying yourself.

Budget Versus Cash Flow

The main difference between a Budget and a Cash Flow is that a Budget uses estimates and a Cash Flow uses actual amounts. A Budget is an estimate, done before the money is earned and spent or set aside. A Cash Flow shows actual results of earnings, expenses, and money set aside. It is also useful to compare your Budget with what actually happened. This helps you to make your future Budgets more accurate.

How to Play

- Choose a PERIOD.

- Under MONEY IN, click ADD MORE and enter the description and amount of an item you want to add. The amount should be the estimated or actual amount received during the set PERIOD. Repeat this step to add all MONEY IN. Click the trash can to remove an item.

- Under MONEY OUT, click ADD MORE and enter the description and amount of an item you want to add. The amount should be the estimated or actual amount received during the set PERIOD. Repeat this step to add all MONEY OUT. Click the trash can to remove an item.

- CASH FLOW is automatically calculated based on MONEY IN minus MONEY OUT. If you change the PERIOD after you enter MONEY IN or OUT items, they will be recalculated based on the new PERIOD.

- Use the PRINT button to print to paper or save as an electronic file (pdf). Write your name down on the printout if you will be submitting to an instructor.

- Use the RESET button to erase your data or start over.

Mo

Play this activity to determine the Budget & Cash Flow for Mo, based on his current income and expenses. When calculating monthly amounts, multiply weekly amounts by four (this is not quite exact, but keeps it simple).

You

Complete your own Budget & Cash Flow.

| Learn more about this topic |

|---|

5. Buy & Sell Activity

Wants are things that you might wish to have, but not having them will not threaten your existence, such as a new television, video games, and taking a vacation. Wants are items you can live without, but would very much like to have.

Depreciation is when the value of an item decreases over time. Most items depreciate in value – some faster than others. Automobiles, computers, and smartphones are example of items that quickly depreciate in value.

The financial value of an item is usually based on the amount that someone is willing and able to pay for the item. If an item is difficult to sell, then its value becomes questionable. You may have strong feelings about an item, but such sentimental value is not factored into the actual financial value of an item.

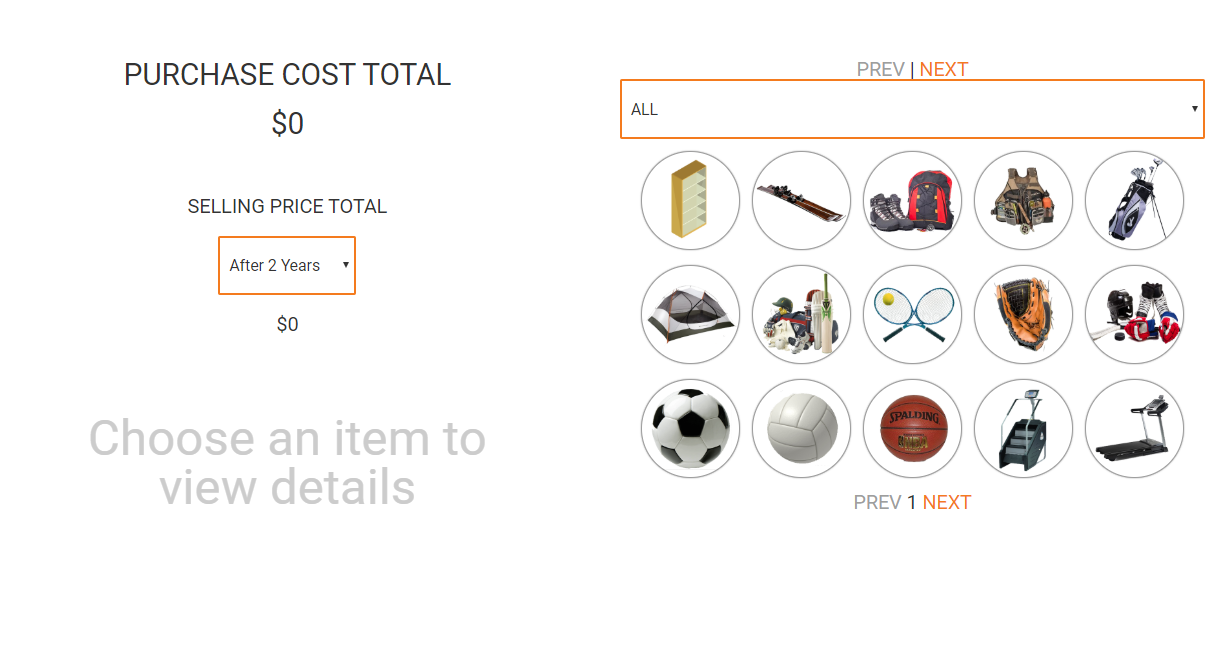

How to Play

- Review the items available to purchase. Click the NEXT or PREV links to scroll through the items or use the dropdown to jump to a specific category.

- Click an item to view its details. Click BUY to purchase it. Once an item is purchased, a checkmark will appear over it.

- To sell a purchased item, click it then click SELL. The item will be sold for the depreciated SELL PRICE.

- Monitor the PURCHASE COST TOTAL to see how much all of your items will cost. Experiment with the SELLING PRICE TOTAL to see how your items will depreciate in value over time.

- Use the PRINT button to print to paper or save as an electronic file (pdf). Write your name down on the printout if you will be submitting to an instructor.

- Use the RESET button to erase your data or start over.

Mo

Play this activity to select 25 items that Mo will need in his life. Experiment with changing the number of years owned and sold to see how depreciation affects the value of items.

You

Complete your own Buy & Sell activity.

| Learn more about this topic |

|---|

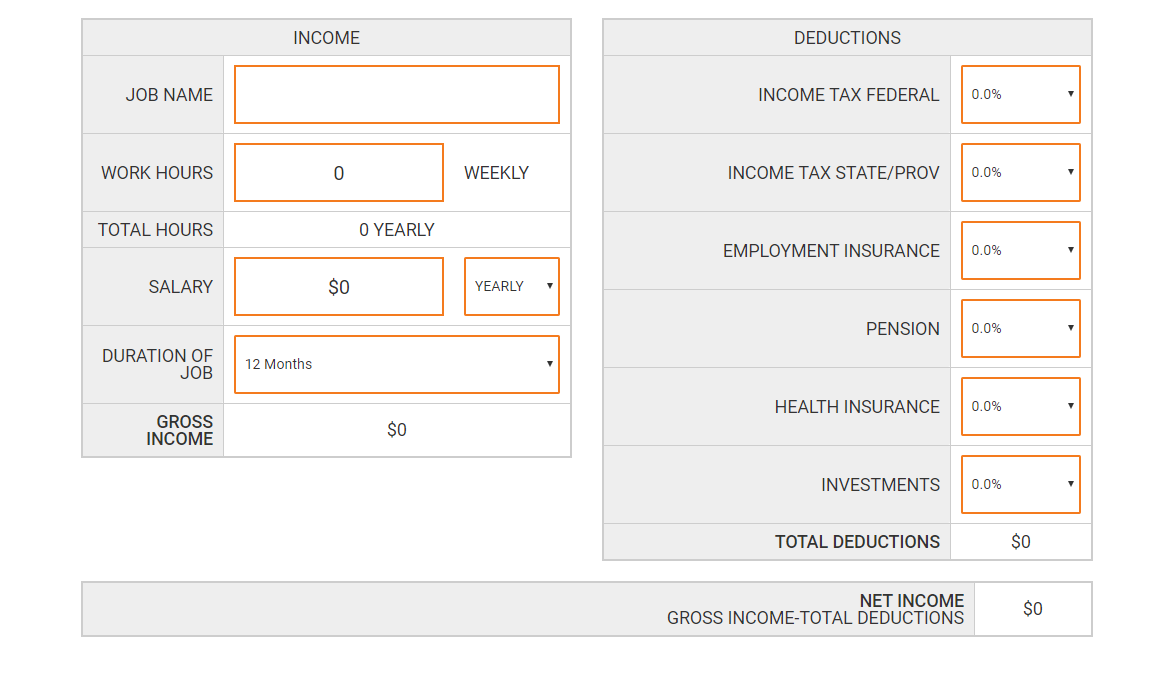

6. Job Income Activity

Job INCOME is the wages and other financial benefits (like tips and bonuses) you earn while doing the Job. Your Job Income is subject to deductions and taxes by the government.

Some Jobs pay a salary while others pay hourly.

Hourly pay means you are paid a certain amount for each hour that you work. Salary means you are paid a fixed amount for the year and you are given a partial payment at set times during the year, such as every month or every two weeks.

Deductions are amounts that are taken from your pay by the employer and sent to the government. Taxes are an important part of contributing to society and are used to fund government operations and initiatives, such as roads, schools, first responders, and more.

Terms to Know:

INCOME

WORK HOURS

Most full-time jobs range between 30 to 40 hours each week. People who work shifts or part time may have varied work hours.

EARNINGS

The total amount you are paid, including tips and bonuses. Earnings are considered income.

GROSS INCOME

The total amount of money you earn from the job for a given time period. Gross Income is calculated before any deductions are made to your pay.

DEDUCTIONS

INCOME TAX FEDERAL

Tax rate charged by the Federal Government. This is calculated based on your Gross Income and deducted from your pay. You can find the tax rate on your government website.

INCOME TAX PROVINCIAL

Tax rate charged by the Provincial Government. This is calculated based on your Gross Income and deducted from your pay. You can find the tax rate on your government website.

EMPLOYMENT INSURANCE

A government deduction from your pay that is added to a national fund to help support people who are between jobs. This is sometimes called Unemployment Benefits. You are required to contribute a portion of your pay. Your employer must also contribute an additional amount, which is not considered part of your earnings.

CPP PENSION

A government deduction from your pay that is used to provide money to seniors in retirement. This is usually called a Canada Pension Plan or Social Security. You are required to contribute a portion of your pay. Your employer must also contribute an additional amount, which is not considered part of your earnings.

HEALTH INSURANCE

A deduction from your pay used to provide you with health insurance. Not all employers offer this benefit. Employers that do offer health insurance benefits may pay the full amount of the health insurance premium or they may pay a partial amount with the employee paying the remaining amount through a payroll deduction.

INVESTMENTS

Employees may request that their employer deduct an amount from their earnings and apply it towards an investment owned by the employee, such as retirement savings, mutual funds, stock purchase plan, etc. Some employers will match funds invested by the employee, thereby increasing the amount available to the employee to invest.

NET INCOME

The total amount of money paid to the employee after deductions have been made to the Gross Income.

- Enter values for each of the items. You may need to research some values.

- Review the GROSS INCOME and NET INCOME to see how they compare.

- Use the PRINT button to print to paper or save as an electronic file (pdf). Write your name down on the printout if you will be submitting to an instructor.

- Use the RESET button to erase your data or start over.

Mo

Play this activity to determine the Job Income for Mo, based on his future job income. When calculating monthly amounts, multiply weekly amounts by four (this is not quite exact, but keep it simple).

You

Complete your own JOB INCOME activity.

| Learn more about this topic |

|---|

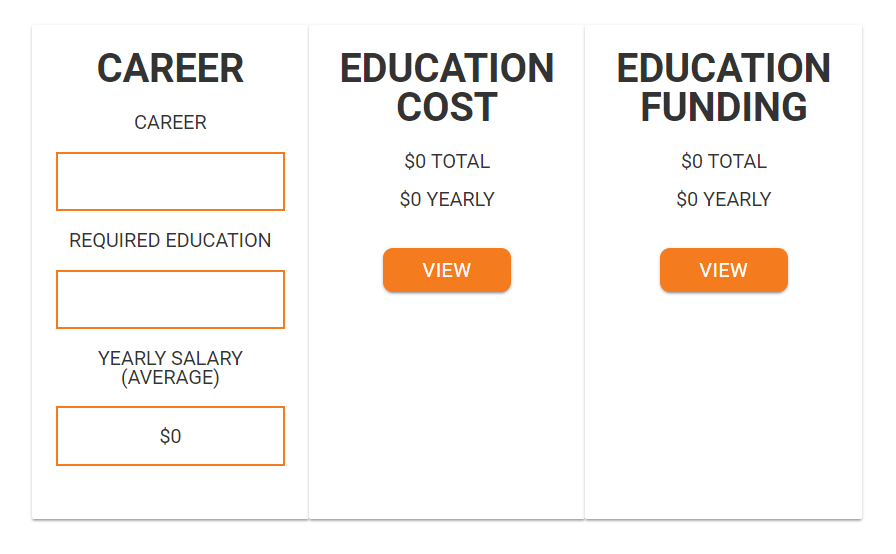

7. Career & Education Activity

Most Jobs require education or skills. Education opens your mind and increases your Job and Career options.

Education can be costly. It is important to plan how to fund your education goals, and to consider how your education will help you in your future Jobs and Career.

Terms to Know

TUITION

The fee charged by the educational institution or training organization. Tuition may not not include cost of books and other materials you may need.

SCHOLARSHIP

Money provided by the educational institution to select students that they want to enroll in their program. Scholarship money is usually applied to reduce the cost of Tuition. Scholarships do not have to be repaid.

GRANT

Money provided by companies, non-profits, or government agencies to help students advance their education. Grants do not have to be repaid, unless the student violates the terms of the grant (such as enrollment status change or grades fall below a required amount).

STUDENT LOAN

Money provided by the government to help a student advance their education. Student loans have to be repaid and sometimes with interest.

STUDENT AID

Students with few financial resources may qualify to receive Student Aid from the government, which could include a combination of grants and loans.

How to Play

- Start by considering the type of JOBS and CAREER you want to have. Then research the EDUCATION you need to achieve these goals. Search for the costs of achieving this EDUCATION.

- Enter values for each of the items. Click VIEW to enter details.

- Reflect on the numbers to see if your EDUCATION FUNDING is sufficient to cover your EDUCATION COSTS. Consider if your EARNINGS will provide a good return on your investment.

- Use the PRINT button to print to paper or save an electronic file (pdf). Write your name down on the printout if you will be submitting to an instructor.

- Use the RESET button to erase your data or start over.

Mo

Play this activity to determine Education Costs and Funding for Mo, based on his future career and education. When calculating monthly amounts, multiply weekly amounts by four (this is not quite exact, but keep it simple).

You

Complete your own CAREER & EDUCATION activity.

| Learn more about this topic |

|---|

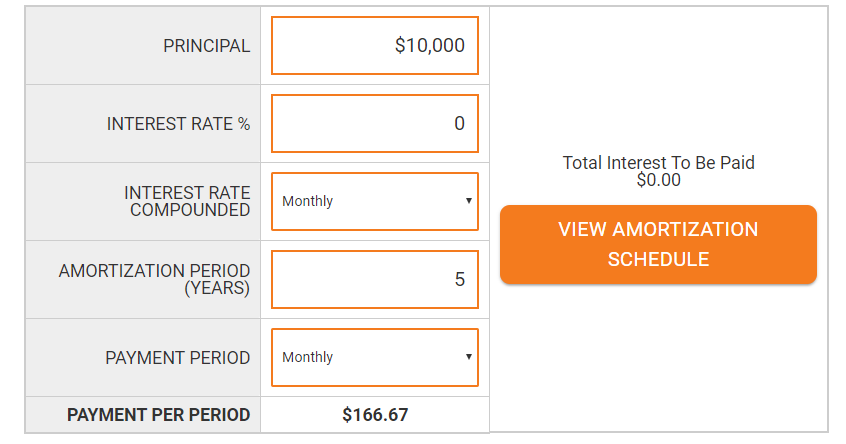

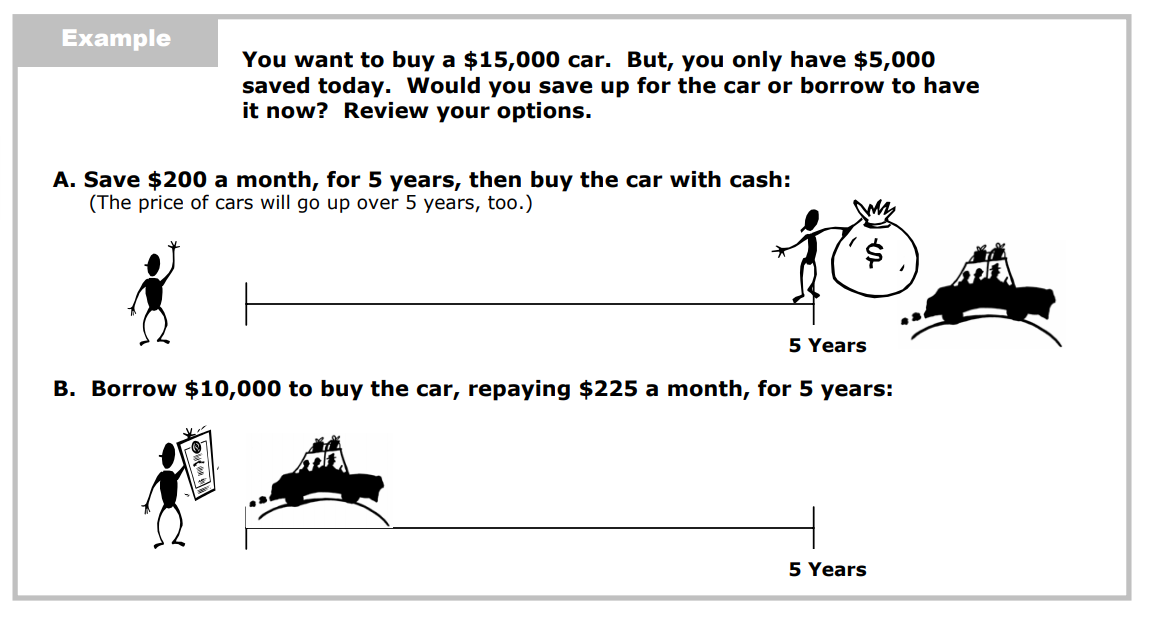

Being able to borrow money allows you to have things before you can afford to pay for them. You may take out a Loan to purchase a home – this type of Loan is called a Mortgage. Then you live there while you repay the debt. You might take a Loan out to buy a car, and repay the Loan while you are driving the car.

Having the ability to borrow can improve your lifestyle and provide greater comfort than you might be able to otherwise afford. Without the ability to borrow, you would only be able to buy things by paying the full purchase price up front with cash.

The Loan Principal is the amount of money you borrow. The Loan Principal is usually repaid in one payment or several smaller payments. This is the Payment Period. Common Payment Periods are weekly, biweekly, and monthly. The total amount of time it takes to fully repay the Loan is called the Amortization Period.

Example: A Loan paid monthly for 12 months has an Amortization Period of 1 year. The amount of each of the 12 payments and the dates on which they are due are set out in an Amortization Schedule.

Loan repayment normally includes an additional amount, called Interest. The lender who gives the Loan risks losing money if the Loan is not fully repaid. Interest is a fee paid to the lender for taking this risk.

Interest is usually calculated as a percentage of the Loan Principal.

Example: Loan Principal is $100 and Interest Rate is 5% means that $5 of Interest will be paid by the borrower, for a total Loan repayment of $100 + $5 = $105.

The frequency in which Interest is calculated is the Compounding Period, and results in more Interest being charged the longer the Loan is unpaid. The more frequently the Interest is calculated (compounded), the higher the Interest costs will be. Concepts of Simple Interest versus Compounding Interest can be somewhat complicated but are worth spending time to learn.

The Interest Rate charged on a Loan will vary based on the Lender, the type of Loan, duration of Loan, and your credit history. If you have not been reliably repaying your debts, then you will have a poor credit history. A poor credit history may cause the Lender to worry about your ability to repay a Loan, and may result in the Lender charging a higher Interest Rate for this increased risk of loaning money to you.

When you consider the cost of borrowing money, you should consider the Interest you will have to pay.

The amount of money you want to borrow.

INTEREST

The extra fee you will pay in addition to the PRINCIPAL. INTEREST RATE is a percentage of the PRINCIPAL.

INTEREST RATE COMPOUNDED

How often Interest is calculated on the Loan – the Compounding Period.

AMORTIZATION PERIOD

The duration of the repayment.

PAYMENT PERIOD

The frequency in which you will make payments.

AMORTIZATION SCHEDULE

The amounts and dates due for each Loan payment.

How to Play

- Enter values for each item.

- Review the PAYMENT PER PERIOD and TOTAL INTEREST TO BE PAID. Experiment with the numbers to see how they change.

- Use the PRINT button to print to paper or save as an electronic file (pdf). Write your name down on the printout if you will be submitting to an instructor.

- Use the RESET button to erase your data or start over.

Mo

Play this activity to determine the biweekly car payment and monthly loan (mortgage) payment for Mo, based on his future loans.

You

Complete your own LOANS activity.

| Learn more about this topic |

|---|

9. Investing & ROI Activity

Investments are assets that you purchase or receive with the expectation that they will increase in value. The increase in value may come from periodic payments or an increase in overall value of the asset that you can sell at a higher price.

Return On Investment (ROI) is the amount that something has increased or decreased in value. It is often shown as a percentage of the original investment amount.

Example: You invest $100 and after a period of time get $110 back. This means your ROI is $10 – this is how much you earned on the investment. To convert that to a percentage, divide the amount earned of $10 by the original amount of $100 and multiply by 100% which equals a 10% ROI. This is a simple way of calculating ROI, but there are more complex methods to determine yearly rate of return and other numbers.

Example of investments

MONEY MARKET

A money market fund is an investment that pays interest while keeping the principal amount of the investment safe. Examples are Government Treasury bills (T-bills), Guaranteed Investment Certificates (GICs), and Certificates of Deposit (CD).

MUTUAL FUNDS

Mutual funds are sets of investment assets grouped into a specific fund, that is managed by investment companies or investment divisions of banks and insurance companies. A mutual fund may be set up to hold any combination of stocks, bonds, mortgages, money market instruments, and more.

STOCKS

A company can raise money by selling stock (shares). A share is a percentage of ownership in the company. People who own shares in a company are called shareholders. A company can have one shareholder or millions. Shareholders can make money on their stock by selling their shares at a higher price than they paid to buy them. Some companies also pay dividends to their shareholders. Dividends are a percentage of profits earned by the business.

BONDS

A bond is a debt instrument that is repaid in one year or more. Organizations, including companies and governments, issue bonds to raise money. By purchasing a bond, you are loaning your money to that organization. Buying a bond makes you a creditor (lender), but not an owner or shareholder, of the organization which issues the bond.

Most bonds have a stated rate of interest, called the coupon rate, which is paid for the life of the bond. Upon maturity, the organization that issued the debt repays the amount stipulated on each bond. This amount is called par value, or face value.

PRECIOUS METALS

Gold, silver and other precious metals are traded as investments. These investments can be held in the form of bullion (the actual metal) or certificate of ownership. They are often traded on world markets, and prices fluctuate with worldwide demand and availability. Some investors purchase precious metals because they believe there are both the potential for an increase in value and a reduced risk of losing their investment, because of the intrinsic value of the metal itself.

CRYPTOCURRENCY

Cryptocurrency is like paper money but in digital form. A cryptocurrency is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets. Cryptocurrency is used to pay for goods and services and is traded on currency markets. As the value of your cryptocurrency increases, you are able to buy more goods and services or you may be able sell your currency to another investor for a higher price than you paid for it.

REAL ESTATE

Rental property is a form of investment. Rent is a fixed, periodic payment made by a tenant or occupant of a property to the owner for the possession and use of the property. You can earn rent by owning and renting an apartment or house or leasing a commercial property. Your real estate holdings may also increase in value, allowing you to sell the real estate at a higher price than you paid to purchase and maintain the property.

Inflation

When determining the ROI to be gained on an investment, you should also consider how Inflation may affect your overall ROI.

The time value of money means, in part, that the worth of money changes over time. As time passes, each dollar will usually buy less and less value. This is called inflation. As the prices of goods rise over time, a dollar in the future will not buy as many goods as it does today.

How to Play

- Enter values for each of the items. The BUY field is how much you paid for an investment. The SELL field is how much you sold the investment. If the SELL amount is higher than the BUY amount, then you will see a positive ROI, otherwise it will be zero or negative. For BONDS and MONEY MARKET, the BUY and SELL amounts are the same and you can enter the INTEREST earned on the investment.

- Review the numbers and experiment with INFLATION and other values to see how the ROI changes.

- Use the PRINT button to print to paper or save as a electronic file (pdf). Write your name down on the printout if you will be submitting to an instructor.

- Use the RESET button to erase your data or start over.

Mo

Play this activity to determine the ROI for Mo, based on his future investing. Experiment with different years and inflation amounts to see how the ROI changes.

You

Complete your own INVESTING & ROI activity.

| Learn more about this topic |

|---|

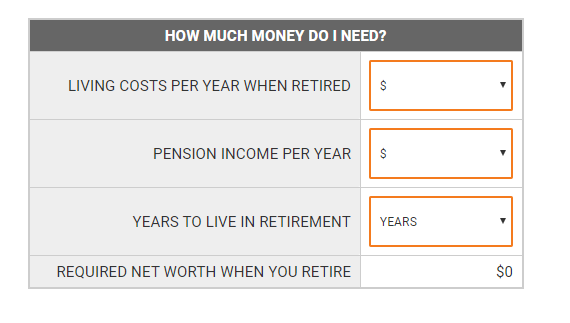

10. Retirement Activity

Retirement is the period of your life when you have stopped working at a job, career, or occupation and do not plan to return to actively working. You should plan to have enough money available to pay for your living expenses.

To determine how much money you need for retirement, you have to consider how much money it will cost to maintain your lifestyle and how much money you will be receiving in retirement or have available in savings.

LIVING COSTS

The amount of money needed to support your lifestyle, including basic expenses such as housing, food, taxes, and healthcare. Your lifestyle determines your cost of living. Frugal means you live as inexpensively as possible. Comfortable means you meet all needs and many wants. Living well means you have some luxuries in your life.

PENSION

Pension is money you receive from the government or a former employer when you reach a certain age. Government pension money comes from a pension fund that you pay into while you are working. These payments are part of your employment deductions. Government pension is called Canada Pension in Canada. Some employers offer pensions to employees that meet certain requirements or service.

NET WORTH

Net Worth, also called equity, is the total worth of the things you own (your assets) minus all your debts (your liabilities). Or, you can think of it as the amount you would have left over if you sold all your assets and paid off every single one of your debts today.

How to Play

- Enter values for each of the items. You may need to research cost of living and consider inflation.

- Review the numbers and experiment to see how they change.

- Use the PRINT button to print to paper or save as an electronic file (pdf). Write your name down on the printout if you will be submitting to an instructor.

- Use the RESET button to erase your data or start over.

Mo

Play this activity to determine the required Net Worth at retirement for Mo, based on his retirement plans.

You

Complete your own RETIREMENT activity.

| Learn more about this topic |

|---|

Mo's Profile

Mo is a fictional character that you can help by completing personal financial literacy activities.

- Mo lives in the town of Springfield. He just graduated high school and has plans for his future

- Mo wants to have a good career as an architect and is willing to work hard to achieve his goals.

- Mo’s views on money are that he is willing to work hard and take some risks to achieve his financial goals. Mo is quite happy to live a comfortable life. He does not consider having luxuries or great wealth to be very important to him. He would like to achieve financial freedom to retire somewhat early.

Mo's Life Plan

- Received gift ($0 cost) of a camera this month.

- Purchase used smartphone in 1 month for $200.

- Purchase new computer in 2 months for $900.

- Receive gift of a bicycle ($0 cost) in 3 months.

- Get drivers license in 4 months for $250 (includes lessons).

- Buy work clothes for his lawn care business in 6 months for $200.

- Get part-time job at pizza restaurant in 9 months.

- Buy new video game console in 1 year for $400.

- Sign up for the new basketball league in 14 months $120.

- Attend university in 2 years to study Architecture. Repeat this goal each year for 5 years in total with each year costing $24,000.

- Get a job as a Junior Architect in 8 years. Yearly earnings of $45,000 and have this job for 5 years. Then get a job as a Senior Architect with yearly earnings of $70,000 and have this job for 10 years.

- Buy a car in 8 years - a used Ford SUV. Purchase cost of $20,000 with a down payment of $2,000 and a monthly loan payment of $366 at 3% interest. Sell it after 6 years.

- Take a vacation to Asia in 10 years at a cost of $2,000.

- Buy a 3-bedroom home in Springfield in 12 years. Purchase cost of $200,000 with a down payment of $20,000. Monthly loan payment of $1,177 at 5% interest. No plan to sell this home at this time.

- Buy a car in 14 years - a new Acura SUV. Purchase cost of $50,000 with a down payment of $5,000 and a monthly loan payment of $808 at 3% interest. Sell it after 6 years.

- In 16 years, add a Family goal to find a life partner and have a small wedding at a cost of $8,000.

- In 18 years, add a Family goal with yearly childcare costs of $8,000 and support the child for 18 years.

- In 20 years, set a retirement plan of having a yearly income of $50,000. This is not the year when Mo plans to retire, but is when he will check on his planning progress.

Assets and Liabilities

- Mo purchased a new computer for $900 and owns a $1,000 mountain bike he received as a gift. He recently purchased a used smartphone from his friend for $200. Mo owns a lawn mower, valued at $350, that he uses to make money in the summer. He also owns a camera valued at $300.

- Mo has a credit card with a $300 limit and he has an unpaid balance of $125.

- Mo borrowed $200 from his parents to start a lawn care business in the summer and he plans to pay the money back soon.

- Mo borrowed $75 from a friend – he repaid $40 and still owes the rest.

Income and Expenses

- Mo has a part-time job making pizzas. He earns $12 per hour and receives about $30 in tips each week. He works 20 hours each week.

- Mo’s own part-time lawn care business generates $275 each week, but he has to pay $100 in expenses, so his actual gross earnings are only $175 each week.

- Mo has been living at home but he just moved into an apartment with a friend. Mo’s share of the rent is $500 per month. He also pays $50 each month for energy and related utilities, $10 for maintenance, and $12 for insurance.

- Purchasing groceries costs Mo $75 each week and he spends $50 each week at restaurants. He also spends $30 each week on entertainment and $10 each week to play in a basketball league. Mo enjoys photography and spends $25 each month on this hobby.

- Mo spends $25 each month for work clothes and $20 for casual clothes.

- Mo spends $20 on a haircut each month and another $30 for personal care items.

- Mo is single and does not have any kids, but hopes to someday.

- Mo has a smartphone and a service plan that cost $28 each month. He has Internet at his apartment, which he shares with his roommate and each of them pay $20 per month. Mo has two video subscription that cost a total of $22 each month.

- Mo is healthy but has a minor medical condition that requires medication that costs him $15 each week. Mo wants the peace of mind of having health insurance in case he gets sick and has to purchase medication. He pays $15 each month for health insurance.

- Mo is currently taking a summer course to learn computer programming. It costs $50 each month for tuition and resources.

- Mo donates $10 each month to a local cause where he volunteers occasionally.

- Mo commutes using public transportation that costs him $55 each month. His roommate has a car which Mo contributes $10 each week for gas and $5 each week for parking.

- Mo saves $100 each month for the future and sets aside another $20 in an emergency fund.

Future Job Income

- Mo wants to be an architect. He has researched the job and discovered that, in his local area, he can expect to earn $70,000 each year, once he gains some experience. The job is 45 hours each week (choose 12 months for duration).

- Mo is aware that his earnings above won’t be the actual amount of money he will receive. After deductions, it will be much less. In addition to the tax deductions listed below, Mo also plans to buy into the company health insurance plan, which will cost him 5%, and he wants to invest 8% of his earnings to be automatically deducted from his pay.

Taxes

- Federal Income Tax rate is 20%

- State/Provincial Income Tax rate is 5%

- Employment Insurance is 2%

- Government Pension Rate is 4%

- Mo wants to be an architect. He has researched the job and discovered that, in his local area, he can expect to earn $70,000 each year, once he gains some experience.

- The Bachelor of Architecture degree Mo plans to pursue will require 5 years of full-time study at a university. Tuition is $10,000 per year and $800 for books and other materials. Living and other expenses will be $13,200 each year, made up of $7,900 for housing, $300 for communications, $2,000 for food and groceries, $1,000 for transportation, $500 for clothing, $1,000 for recreation, and $500 miscellaneous.

- To cover the costs of education, Mo has a number of sources for education funds. Mo plans to save $5,000 each year from working that he can apply towards his education costs. He thinks he has a good chance at winning a scholarship that will provide him with $6,000 each year. And he has already been awarded an education grant of $2,000 per year for doing well in high school. He will take out a student loan of $11,000 each year to cover the remainder of his education costs. Mo does not qualify for student aid or other funding programs.

- Mo plans to purchase a new car when he graduates college. His budget will be $20,000 and he will make biweekly payments for 4 years. He expects the interest rate to be 3%, compounded yearly.

- Mo plans to purchase a house by the time he is 30. He hopes to have enough savings to put a downpayment of $20,000. His budget to purchase a home will be $200,000, which means he will have to borrow $180,000 as a loan (mortgage). He expects the interest rate to be fixed at 5%, compounded yearly. He will make monthly payments for 20 years.

- Mo is a planner. It’s one of the reasons he wants to be an architect. As part of his planning, he considers the cost of everyday items.

- Mo tends to buy items that he needs. For items that he wants (more than needs), he purchases items that enrich his life in some way.

- Review the other sections of Mo’s profile to get a better idea of the type of products he might purchase.

- Purchase mutual funds at $2,000 and expect to sell them in a few years for $2,500.

- Purchase stock in the local energy company. Purchase 100 shares at $50 per share for a total of $5,000. The company is showing small but reliable growth and he expects to sell his shares for $6,000. The company issues dividends that he expects to total $500.

- Purchase a government Certificate of Deposit on the Money Market for $1,000 which earns 4% ($40) interest.

- Purchase 6 federal government bonds at $1,000 each for a total of $6,000. The total interest earned is 6% ($360).

- Mo expects to do some consulting work that will pay him in Bitcoin cryptocurrency. He expects to be paid 2 Bitcoins with a total value of $3,000. If Bitcoin value rises, he will sell it for $4,000.

- Mo likes the intrinsic value of precious metals, particularly gold. He plans to buy 2 ounces of gold for a total cost of $2,500. He expects to sell for $3,200.

- Mo would like to buy a house that he can rent for $1,500 per month. He expects the property to cost $200,000 to purchase and renovate and hopes to sell it for $225,000.

- For Net Income (Yearly) Mo has no other Interest or Other income to include (leave both as $0).

- Mo expects inflation to be 3%.

- Mo is determined to plan well for retirement. Perhaps even retire early, if possible. He estimates that by the time he reaches retirement age, with inflation, his yearly living costs will be $50,000.

- Mo expects his government and employer pension income to be $30,000 each year.

- Mo projects he will live 25 years in retirement.